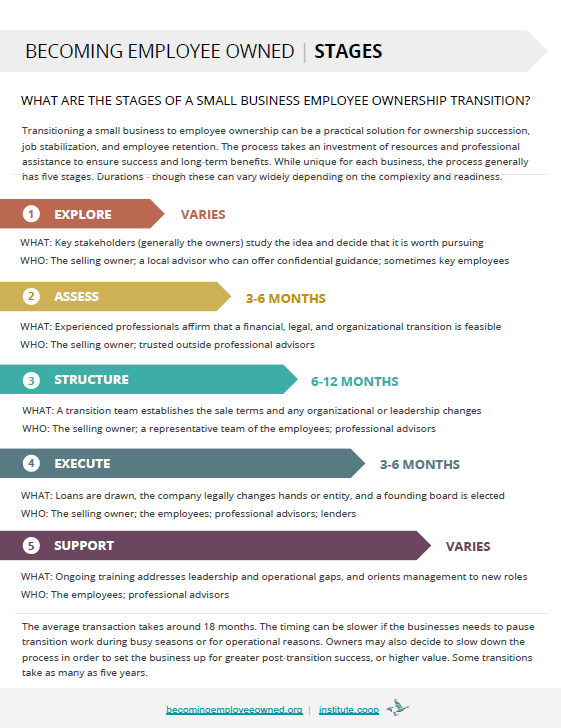

Converting a small business to employee ownership can be a practical solution for ownership succession, job stabilization, and employee retention. The process takes an investment of resources and professional assistance to ensure success and long-term benefits. While unique for each business, the process generally has five stages.

In the Explore stage, the owner learns the benefits and options of employee ownership and decides whether to invest further time and resources. During this stage it is helpful to have a knowledgeable local champion of the idea to speak to in confidence, and an opportunity to see how other businesses have made the transition. The essential question is whether employee ownership will meet the outcomes desired by the seller. Outcomes may be financial security, community benefit, or maintaining the legacy of the business.

WHAT: Key stakeholders, generally the owners, study the idea and decide that it is worth pursuing

WHO: The selling owner; a local advisor who can offer confidential guidance; sometimes key employees

In the Assess stage, experienced professionals are invited to look at whether the value of the business will be enough to meet the seller’s needs. The advisors will propose the best legal structure for the sale to preserve value and maintain continuity. They will also examine the organizational capacity to take on new leadership and managerial responsibilities if the owner exits. A recommendation will either be made to move forward or to make changes that will increase company value and employee readiness.

WHAT: Experienced professionals affirm that a financial, legal, and organizational transition is feasible

WHO: The selling owner; trusted outside professional advisors

In the Structure stage, employees will become engaged in preparing for the transition. General information will be offered to all employees to gauge interest, and a smaller group will regularly meet to understand the details of the sale and give input on the terms. The group usually focuses on gaining financial literacy and understanding how governance and management will operate under employee ownership. At the same time, advisors are at work structuring bylaws, securing capital, and addressing any special needs.

WHAT: A transition team establishes the sale terms and any organizational or leadership changes

WHO: The selling owner; a representative team of the employees; professional advisors

In the Execute stage, all activities – legal, financial, and organizational – intersect to finalize the transaction. Purchase agreements are signed by employees. New legal entities are ratified and founding boards chosen. Loans are drawn on for the initial cash payment to the seller. If any leadership or management structures are planned for the execution of the sale, they begin. This stage requires committed attention from either an advisor or an internal champion to move slow external processes forward and keep employee morale high.

WHAT: Loans are drawn, the company legally changes hands or entity, and a founding board is elected

WHO: The selling owner; the employees; professional advisors; lenders

In the Support stage, the development of ownership practices and attitudes is guided through the inevitable bumps and growing pains. Employees gain business literacy to see how their everyday effort can reward them financially. They set personnel practices that foster engagement. Roles for the board, management, and members are established. Training from professional associations, business schools, and cooperative experts assures that educational needs are not deferred by operational ups and downs.

WHAT: Ongoing training addresses leadership and operational gaps, and builds ownership culture

WHO: The employees; professional advisors

This one-page handout briefly reviews what happens during each of the five stages, and who is involved.