An independent third party valuation of a business can be a useful starting point from which to find an acceptable sale price. An independent review can be good for both parties to find a fair price, and can allay financial anxieties.

Here are some resources on how valuations are done for small business employee ownership transitions

These resources focus specifically on the valuations of childcare businesses.

- ICA Group – What’s It Worth? A Guide To Determining and Increasing the Value Of Your Child Care Business

- ICA Group – Business Valuation 101 for Child Care Businesses (part 1, part 2, part 3)

Employees will want to understand both the total sale price and also their individual cost. In an average employee ownership sale the employees might contribute about 10% of the cost of the sale and the remaining 90% is borrowed. If the business is valued at $100k, the employees as a group may need to find $10k, and if there are 10 of them, they many each need to find $1k.

For a precedent of how low interest SBA microloans being made to support employee owner equity contributions see the study here.

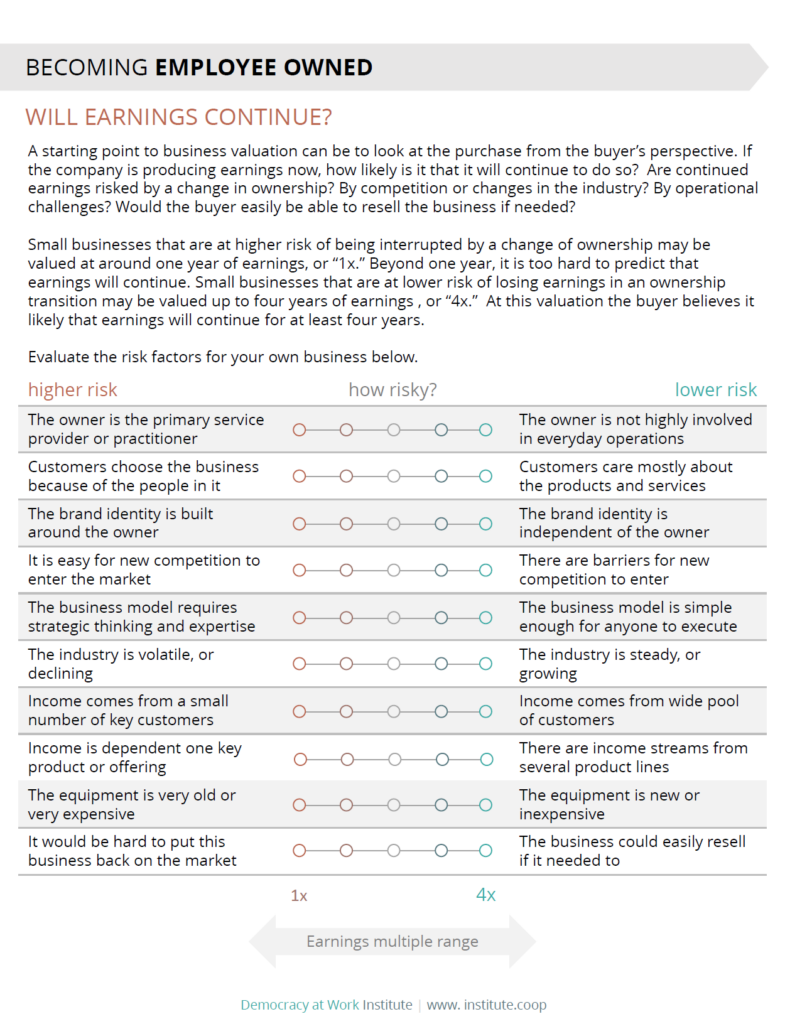

This quick self-assessments asks how reliable future earnings – a common question in valuations. Are continued earnings risked by a change in ownership? By competition or changes in the industry? By operational challenges? Would the buyer easily be able to resell the business if needed?