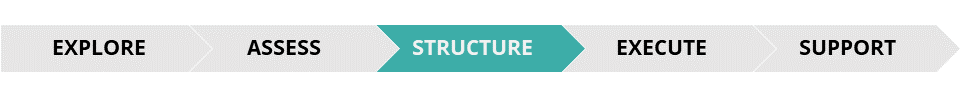

In the Structure stage, employees will become engaged in preparing for the transition. General information will be offered to all employees to gauge interest, and a smaller group will regularly meet to understand the details of the sale and give input on the terms. The group usually focuses on gaining financial literacy and understanding how governance and management will operate under employee ownership. At the same time, advisors are at work structuring bylaws, securing capital, and addressing any special needs.

- WHAT: A transition team establishes the sale terms and any organizational or leadership changes

- WHO: The selling owner; a representative team of the employees; professional advisors

How Do I Introduce the Idea of Employee Ownership to the Employees?

In an initial conversation it is important to establish trust, since the topic of company change can create anxiety among employees. Even when noble intentions of shared ownership are expressed, employees may be preoccupied by fear of job loss, or instability.

Employees will be looking to hear that:

- The selling owner can speak honesty about their own desires and concerns

- Unfamiliar aspects of the employee ownership have outside expert support

- There will be a forum for questions and discussion

The seller should speak about their goals and desires from their position as owner:

- What was the original vision for the business, and how has this been fulfilled?

- What personal or professional changes now require a new path forward?

- What paths are being explored?

The seller should be honest about what is important to them in the transition:

- What timeline does the seller see as ideal for the transition?

- What does the seller see as the ideal outcome for personnel?

- What does the seller see as the ideal financial outcome?

The employees will want to hear more about how a sale would actually work, especially about the money:

- What is the estimated business sale cost, and where does that number come from?

- What would that purchase mean at individual level, and what financing would make it accessible?

- What would profit sharing look like if the company were employee-owned?

The employees will want to know about management and personnel:

- Will the owner exit, or stay, or something in between?

- Who will take on the duties the owner currently fulfills? How will they be trained, and by who?

- Would all employees be expected to become employee-owners, or a subset?

The employees should be asked to air their thoughts and questions

- Would employee ownership meet their vision for working at the business?

- What would they need to know to constructively evaluate the idea?

- What situations or findings would make the path not worth pursuing, from their perspective?

A transition team should be recruited to work with the owner:

- Who will work with the owner and outside experts to develop the idea into a proposal for employees?

What Should an Employee Transition Team Focus on?

An employee transition group should meet regularly to learn more about the potential transition, evaluate the offer, and make and needed decisions about the structure of the business. Here are some topics areas that the group should focus on:

Why become employee owned?

- What were other firms’ motivations

- What are employees’ needs and desires

- What is good about workplace democracy or shared ownership?

What does ownership mean?

- What does ownership mean? Freedom? Profit? Loyalty?

- What would the rights and responsibilities of employee owners be?

- Wt needs to be written into bylaws or operating agreements and what is a cultural practice?

Who decides what?

- What is the circle of membership, governance, and management?

- How does leadership work at all levels?

- What is the role of outsiders – technical assistance, unions?

How do owners have managers?

- What is participatory management?

- What is financial transparency?

- What is accountability systems?

What does a board do?

- How does a board channel members’ voices?

- How does a board oversee management?

- How does a board pursue business strategy?

Can we afford it?

- How does the company generate profit?

- What is the business valuation and preliminary sale price?

- How could employees afford to buy in?

How are Small Business Employee Ownership Transitions Financed?

These guides give an overview of the key issues and technical decisions that need to be made when financing a small business transition to employee ownership.

- CFNE – Are Cooperatives Really So Difficult to Finance? (2018)

- CFNE, Project Equity, DAWI – The Lending Opportunity Of A Generation (2016)

- Co-opLaw.org – Financing Cooperative Conversions

- DAWI – Investing in Worker Ownership (2015)

- Lund – Cooperative Equity and Ownership (2013)

These case studies illustrate a variety of financing models use in recent small business employee ownership transitions.

A Yard & a Half Landscaping, Waltham MA

Island Employee Cooperative, Stonington, ME

New Era Windows, Chicago, IL

The New School of Montpelier, Montpelier, VT

Real Pickles Cooperative, Greenfield, MA

Northwind Renewable Energy, WI

Rock City Employee Cooperative, Rockland ME

Namaste Solar, Boulder CO

- Center for Social Inclusion – Namasté Solar: A Profile In Cooperative Ownership

- Entrepreneur – This Company Asked Its Employees for Cash and Everybody Won

- Learn more

Insource Renewables, Pittsfield ME

The articles and guides below offer more in depth information about financing from members of the Workers to Owners Collaborative.

Cooperative Fund of New England

- CFNE – Are Cooperatives Really So Difficult to Finance? (2018)

- CFNE, Project Equity, DAWI – The Lending Opportunity Of A Generation (2017)

- GEO – Cooperative Fund of New England (2013)

- GEO – SBA Recognizes Worker Cooperatives as Small Businesses (2012)

- CFNE – Cooperative Fund of New England and the Cooperative Capital Fund (2007)

Sustainable Economies Law Center

The Democracy Collaborative

- TDC – Financing Cooperatives (2016)

Democracy at Work Institute

- CFNE, Project Equity, DAWI – The Lending Opportunity Of A Generation (2017)

- DAWI – Investing in Worker Ownership (2015)

ICA Group

- ICA Group – Underwriting Home Care Cooperatives (2018)

- Lund – A Loan Fund for Worker-owned Homecare Cooperatives (2018)

LEAF

Ohio Employee Ownership Center

Project Equity

- Project Equity – Financing FAQ

- Project Equity – Financing Case Studies

- CFNE, Project Equity, DAWI – The Lending Opportunity Of A Generation (2017)

- Project Equity – Addressing the Risk Capital Gap for Worker Cooperative Conversions (2017)

Shared Capital Cooperative

- Shared Capital – Worker Ownership Loan Fund

- Next City – The Co-op With Forty Years of Making Loans to Co-ops (2019)

The Working World

- Next City – Closing the Funding Gap for Worker Cooperatives (2016)

- GEO – The Working World and Financing Workplace Democracy (2013)

University of Wisconsin Center for Cooperatives

Vermont Employee Ownership Center